Contents:

Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings.

According to 15 analysts, the average rating for TGTX stock is “Buy.” The 12-month stock price forecast is $20.27, which is an increase of 35.50% from the latest price. It has a remarkable, outside-audited track record of success, with #1 stocks delivering an average annual return of +25% since 1988. Within the past 30 days, our consensus EPS projection has moved 15.81% lower. TG Therapeutics, Inc. is a fully integrated, commercial stage, biopharmaceutical company. The Company is focused on the acquisition, development and commercialization of novel treatments for B-cell diseases.

What is TG Therapeutics Inc’s stock style?

TG Therapeutics faces risks and challenges that may impact its future growth and success. These include changes in healthcare policy and pricing pressures from payers and increased competition from other companies in the market. Additionally, the company is subject to regulatory oversight and must successfully navigate the clinical development and approval process for its product candidates. Failure to do so may result in delays, increased costs, and potential setbacks for the company.

Stocks Mixed Before The Open As Fed Fears Persist, Target … – Barchart

Stocks Mixed Before The Open As Fed Fears Persist, Target ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

This suggests a possible upside of 22.8% from the stock’s current price. View analysts price targets for TGTX or view top-rated stocks among Wall Street analysts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year. These returns cover a period from January 1, 1988 through February 6, 2023.

TG Therapeutics Inc is a biopharmaceutical company that develops and commercializes innovative treatments for multiple sclerosis and other autoimmune diseases. The company, founded in 2012, is headquartered in New York City and has operations in the United States and Europe. The company aims to provide new and effective therapies to patients with unmet medical needs. According to analysts’ consensus price target of $18.00, TG Therapeutics has a forecasted upside of 22.8% from its current price of $14.66.

Quotes & News

The company’s shares opened today at $14.48.According to Tip… A look at the daily price movement shows that the last close reads $16.73, with intraday deals fluctuated between $13.43 and $15.90. Taking into account the 52-week price action we note that the stock hit a 52-week high of $19.59 and 52-week low of $3.48. The company’s financial performance is also subject to risks, such as changes in interest rates and the availability of financing. The company’s debt levels may limit its ability to invest in research and development. Any significant changes in ownership or management may also disrupt operations and impact the company’s growth potential.

That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank.

- Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

- TG Therapeutics Inc is a biopharmaceutical company that develops and commercializes innovative treatments for multiple sclerosis and other autoimmune diseases.

- That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

- The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank.

- Within the past 30 days, our consensus EPS projection has moved 15.81% lower.

Real-time analyst ratings, insider transactions, earnings data, and more. TG Therapeutics’ stock was trading at $11.83 on January 1st, 2023. Since then, TGTX shares have increased https://day-trading.info/ by 23.9% and is now trading at $14.66. TG Therapeutics has been the subject of 6 research reports in the past 90 days, demonstrating strong analyst interest in this stock.

TG Therapeutics has received a 40.42% net impact score from Upright. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

The technique has proven to be very useful for finding positive surprises. The average of price targets set by Wall Street analysts indicates a potential upside of 151.2% in TG Therapeutics . While the effectiveness of this highly sought-after metric is questionable, t… The mean of analysts’ price targets for TG Therapeutics points to a 154.7% upside in the stock.

Thinking about buying stock in Palisade Bio, Kala Pharmaceuticals, F-Star Therapeutics, Nuwellis, or TG Therapeutics?

This model considers these estimate changes and provides a simple, actionable rating system. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous sucden financial reveals new brand identity report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Provide specific products and services to you, such as portfolio management or data aggregation.

Especially since the man behind this company is a serial entrepreneur who has been wildly successful over the years. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

While this highly sought-after metric has not proven reasonably effective, strong agreement among… TG Therapeutics Inc TGTX shares are trading higher by 9.34% to $9.25 Thursday morning. Research indicates that these estimate revisions are directly correlated with near-term share price momentum.

Earnings and Valuation

Make sure to utilize Zacks.com to follow all of these stock-moving metrics, and more, in the coming trading sessions. The Zacks Industry Rank includes is listed in order from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1. For the full year, our Zacks Consensus Estimates are projecting earnings of -$1.22 per share and revenue of $82.22 million, which would represent changes of +16.44% and +2853.39%, respectively, from the prior year. TG Therapeutics closed at $14.79 in the latest trading session, marking a -0.6% move from the prior day. This change was narrower than the S&P 500’s daily loss of 0.7%.

TG Therapeutics: We Are Just Hanging In There (NASDAQ:TGTX) – Seeking Alpha

TG Therapeutics: We Are Just Hanging In There (NASDAQ:TGTX).

Posted: Wed, 21 Sep 2022 07:00:00 GMT [source]

Sign Up NowGet this delivered to your inbox, and more info about our products and services. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

The industry is also subject to political and economic pressures, including changes in healthcare policy and pricing pressures from payers. Only 8.60% of the stock of TG Therapeutics is held by insiders. Only 20 people have added TG Therapeutics to their MarketBeat watchlist in the last 30 days. Only 30 people have searched for TGTX on MarketBeat in the last 30 days. TG Therapeutics does not have a long track record of dividend growth. Upgrade to MarketBeat Daily Premium to add more stocks to your watchlist.

These recent revisions tend to reflect the evolving nature of short-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook. Coming into today, shares of the biopharmaceutical company had lost 21.68% in the past month. In that same time, the Medical sector lost 4.27%, while the S&P 500 lost 5.06%. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades.

TG Therapeutics, Inc. engages in the acquisition, development, and commercialization of novel treatments for B-cell malignancies and autoimmune diseases. Its product pipeline includes TG-1501, TG-1701, Ublituximab, and Umbralisib. The company was founded by Michael Sean Weiss and Laurence H. Shaw on May 18, 1993 and is headquartered in Morrisville, NC.

Is It Time to Buy TGTX? Shares are up today.

Looking at the stock’s medium term indicators we note that it is averaging as a 50% Buy, while an average of long term indicators are currently assigning the stock as 100% Buy. The average estimate suggests sales growth for the quarter will likely fall by -21.20% when compared to those recorded in the same quarter in the last financial year. Staying with the analyst view, there is a consensus estimate of $4.27 million for the company’s annual revenue in 2022. Per this projection, the revenue is forecast to grow -36.20% below that which the company brought in 2022. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

From this we can glean that short interest is 15.52% of company’s current outstanding shares. Notably, we see that shares short in January rose slightly given the previous month’s figure stood at 20.68 million. But the 19.02% upside, the stock’s price has registered year-to-date as of last trading, will likely reignite investor interest given the prospect of it rallying even higher. 6 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for TG Therapeutics in the last year. There are currently 2 sell ratings and 4 buy ratings for the stock. The consensus among Wall Street analysts is that investors should “hold” TGTX shares.

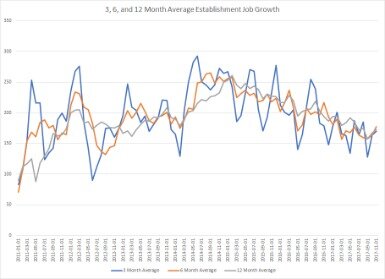

TG Therapeutics Returns vs. S&P

We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. The company is scheduled to release its next quarterly earnings announcement on Tuesday, May 9th 2023. 68.06% of the stock of TG Therapeutics is held by institutions. High institutional ownership can be a signal of strong market trust in this company.